Entering the world of cryptocurrency trading can feel overwhelming. You hear terms like “spot,” “futures,” and “trading pairs,” but understanding how they fit together is a challenge. For any crypto newbie, the first hurdle isn’t just picking a coin—it’s navigating the platform itself. This is where understanding the BTCC markets becomes your first and most critical step toward becoming a confident investor.

BTCC (btcc.finance) offers a robust and user-friendly platform, but to use it effectively, you must first learn the “rules of the road.” What are the different markets available? What are the risks and opportunities associated with each?

This in-depth analysis is designed for beginners. We will demystify the core components of the BTCC exchange, breaking down the btcc spot market and the btcc futures market. We will also provide a foundational guide to analyzing market trends, empowering you to move from a passive observer to an active, informed participant.

What Are the BTCC Markets?

When you hear the term “BTCC markets,” it doesn’t refer to a single, monolithic entity. Instead, it describes the various trading environments offered on the platform where different types of financial transactions occur. As a leading BTCC crypto exchange, the platform is designed to cater to traders with different goals, risk appetites, and experience levels.

For a beginner, the two most important markets to understand are:

- The Spot Market: This is where you buy and sell cryptocurrencies for immediate delivery. It’s the most straightforward and common way to invest in crypto.

- The Futures Market: This is a more advanced market where you buy or sell contracts that speculate on the future price of a cryptocurrency, often using leverage.

Analogy: Think of the spot market as buying a bar of gold and holding it in your hand. Think of the futures market as making a bet with someone on what the price of that gold bar will be next month. Both are valid financial activities, but they serve very different purposes.

Navigating the BTCC Spot Market: A Beginner’s Guide

For 99% of crypto newbies, the btcc spot market is the correct place to start. This market is where assets are traded “on the spot” and settled instantly.

What is Spot Trading?

In simple terms, when you place a “buy” order for Bitcoin on the BTCC spot market, you are purchasing actual Bitcoin with another asset (like USDT, a stablecoin pegged to the US dollar). Once the transaction is complete, you own that Bitcoin. It appears in your BTCC wallet, and you are free to hold it, sell it later, or withdraw it to a private wallet.

The price you pay is the current market price, determined by the supply and demand from other traders on the btcc exchange. There is no leverage, no expiration date, and no complex contract. It is a direct exchange of one asset for another.

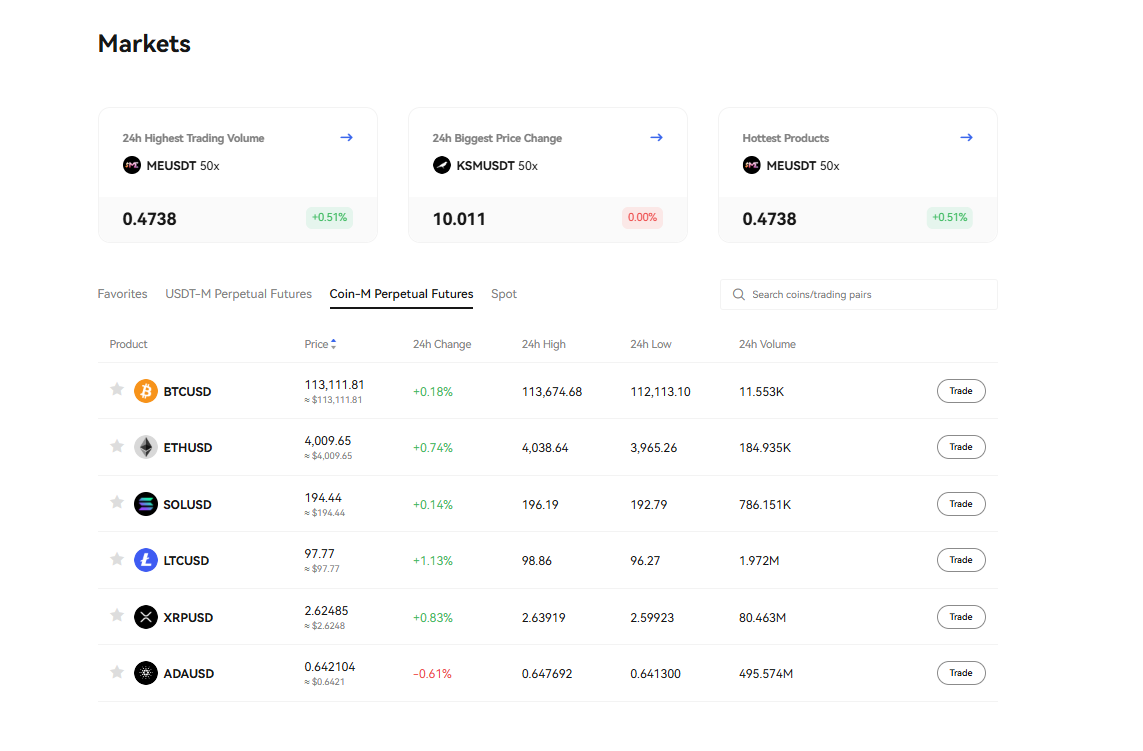

Popular BTCC Trading Pairs

You cannot simply buy a cryptocurrency with any other currency. Trades happen in “pairs.” A trading pair tells you which two assets can be exchanged for one another.

On the btcc crypto markets, you will see pairs listed like:

- BTC/USDT: This means you can buy Bitcoin (BTC) using Tether (USDT), or sell BTC to receive USDT.

- ETH/USDT: You can buy Ethereum (ETH) using USDT, or sell ETH to receive USDT.

- ETH/BTC: This allows you to trade Bitcoin directly for Ethereum, or vice versa.

As a beginner, it is often easiest to fund your account with a stablecoin like USDT and use it as your base currency for buying other cryptocurrencies. The btcc trading pairs list is extensive, offering access to dozens of popular and emerging digital assets.

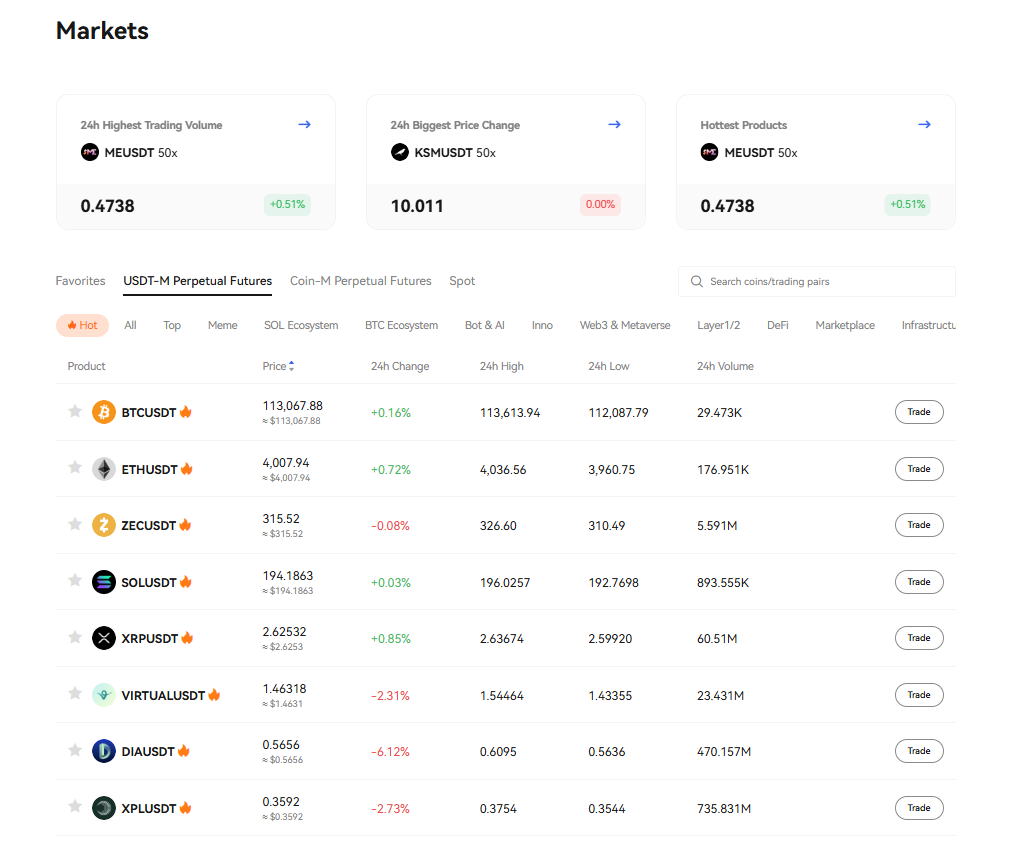

Understanding the BTCC Futures Market

High Risk Warning: The btcc futures market is a powerful tool for advanced traders, but it carries significantly higher risk, especially for beginners. Approach with extreme caution.

A futures contract is an agreement to buy or sell a cryptocurrency at a predetermined price on a specific date in the future. However, in crypto, “perpetual futures” are more common, which are contracts that don’t have an expiration date.

Futures vs. Spot: The Key Differences

The primary difference is ownership and leverage.

- Ownership: In spot trading, you own the underlying asset (the coin). In futures trading, you only own a contract that represents the asset.

- Leverage: This is the most critical difference. The

btcc futures marketallows you to use leverage, meaning you can open a position much larger than your account balance. For example, with $100 and 10x leverage, you can control a $1,000 position.

While leverage can amplify profits (a 5% market move in your favor becomes a 50% profit), it also amplifies losses. That same 5% move against you would wipe out your entire $100.

Why Beginners Should Approach Futures with Caution

The allure of massive, quick profits on the futures market is strong, but it is the fastest way for a new trader to lose their entire investment. Before you ever place a futures trade, you must have a deep understanding of:

- Risk Management: How to set stop-loss orders to limit potential losses.

- Liquidation: The process by which the exchange automatically closes your position at a loss to prevent you from owing more than you have.

- Market Volatility: Crypto is notoriously volatile. A sudden price spike or crash can liquidate a leveraged position in seconds.

Professional Recommendation: Stick to the btcc spot market until you have a proven, profitable trading strategy and fully understand the risks of leverage.

How to Analyze BTCC Crypto Markets

The “analysis and prediction” goal of any trader is to find an edge. You cannot successfully trade on the btcc markets based on guesses or hype alone. Professional traders use a combination of two main analysis methods.

1. Fundamental Analysis (FA)

Fundamental Analysis involves looking at the “big picture” value of a cryptocurrency. Instead of focusing on price charts, you ask questions like:

- What problem does this project solve? Does it have real-world utility?

- Who is the team? Are they experienced and transparent?

- What is the tokenomics? Is the coin inflationary or deflationary? How many coins are in circulation?

- Who are the partners and backers? Is the project supported by reputable institutions?

FA helps you decide if a coin is a good long-term investment. A project with strong fundamentals is more likely to survive a bear market and grow over time.

2. Technical Analysis (TA)

Technical Analysis is the study of price charts and trading statistics. The core belief is that all known information is already reflected in the price, and that price movements tend to follow patterns.

TA involves using tools and concepts like:

- Support and Resistance: Price levels where the market tends to stop falling (support) or stop rising (resistance).

- Moving Averages: A line that smooths out price data to show the underlying trend.

- Trading Volume: The amount of an asset traded in a given period. High volume can confirm a trend’s strength.

TA helps you decide when to buy or sell. For example, you might use FA to decide you want to buy Bitcoin, but use TA to wait for a price pullback to a key support level before you enter the market.

This is a deep topic, and we highly recommend further study. For a deeper dive into chart patterns and indicators, explore our complete guide to technical analysis for crypto traders.

Getting Started: Your BTCC Login and First Trade

Ready to take the first step? The BTCC platform is designed to be intuitive for beginners. Here’s how you can get started on the spot market.

Step-by-Step: Creating Your Account

Visit the Sign-Up Page: The first step is to register for your free BTCC account.

Provide Your Details: You will need to provide an email address or phone number and create a secure password.

Secure Your Account: Immediately after your

btcc login, navigate to the security settings. It is essential that you enable Two-Factor Authentication (2FA), usually via Google Authenticator or SMS. This provides a critical layer of protection for your funds.Fund Your Account: You can deposit cryptocurrency you own from another wallet or, depending on your region, purchase crypto directly with fiat currency (like USD, EUR, etc.).

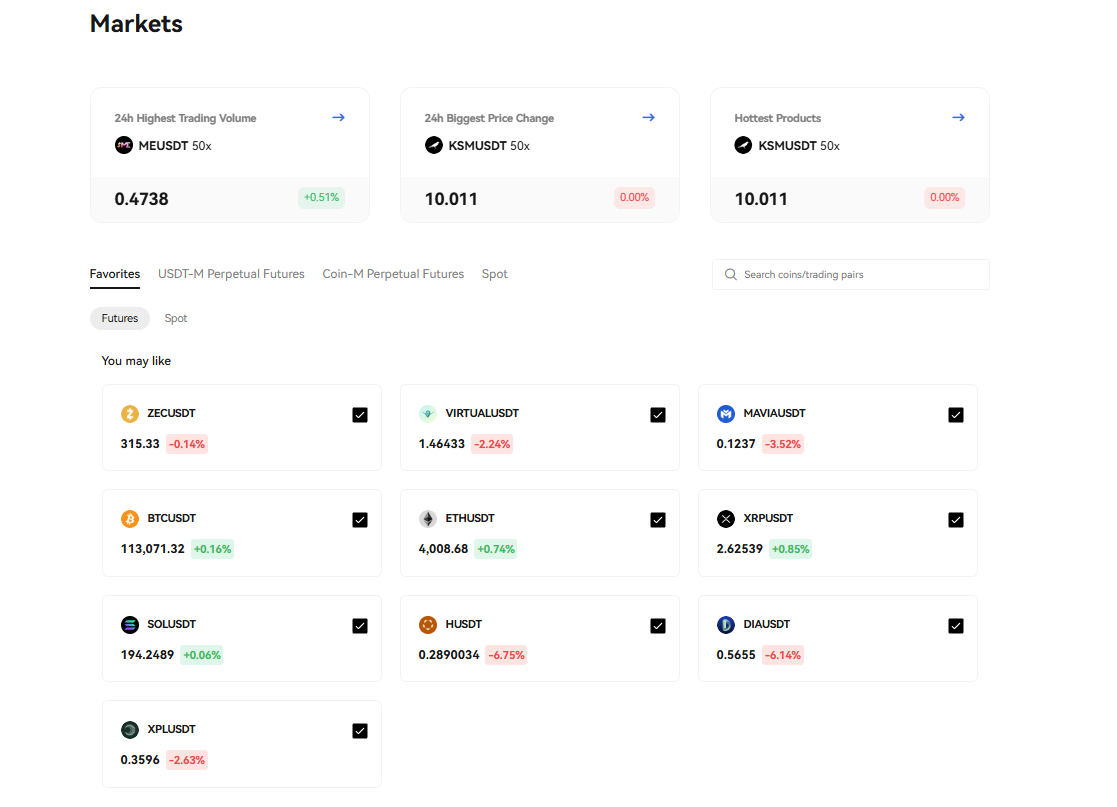

Placing Your First Order on the Markets BTCC Platform

Once your account is funded (e.g., with USDT), you can make your first trade.

Navigate to the “Spot” or “Markets” section of the exchange.

Select the

btcc trading pairyou wish to trade (e.g., BTC/USDT).Find the “Order” box (it will have “Buy” and “Sell” options).

Choose a “Market Order.” This is the simplest order type. It tells the exchange to buy the asset at the best currently available price.

Enter the amount of USDT you wish to spend or the amount of BTC you wish to buy.

Click the “Buy BTC” button.

That’s it! The transaction will be executed instantly, and the Bitcoin will appear in your BTCC wallet.

Future Trends: What’s Next for BTCC and Crypto Markets?

The btcc crypto markets are constantly evolving. As a new investor, it’s wise to stay informed about major trends that could shape the future of the industry.

- Institutional Adoption: Major financial institutions are increasingly participating in the crypto space. This brings legitimacy and capital but also links crypto more closely to traditional financial markets. This trend is a key topic of discussion for global financial bodies.

- Regulatory Clarity: Governments worldwide are developing regulations for cryptocurrency. While this may seem restrictive, clear rules are essential for mainstream adoption and protecting investors. Always stay informed by following reputable news sources like CoinDesk or Decrypt.

- Tokenization of Real-World Assets (RWAs): A major narrative in finance is the idea of putting real-world assets (like real estate, stocks, or bonds) onto the blockchain as tokens. This could dramatically expand the types of assets available on exchanges like BTCC.

Understanding the full scope of the BTCC markets is the first step to becoming a confident trader.

Ready to Start Your Crypto Journey?

Join the BTCC exchange today and access the spot and futures markets with a secure, user-friendly platform.

Sign Up for FreeConclusion: Begin Your Trading Journey on the BTCC Markets

Navigating the BTCC markets as a crypto newbie is a journey of continuous learning. We have broken down the most critical concepts you need to start:

Key Takeaways for Beginners

- Start with the Spot Market: This is the safest and most direct way to buy and own cryptocurrency.

- Avoid the Futures Market (for now): Do not use leverage until you have significant experience and a deep understanding of risk management.

- Learn to Analyze: Don’t trade on emotion. Start learning the basics of Fundamental Analysis (to find what to buy) and Technical Analysis (to find when to buy).

- Security First: Your

btcc loginis the key to your assets. Secure it with a strong password and 2FA before you deposit any funds.

The world of crypto offers exciting opportunities, but it demands patience and education. By starting with a solid foundation, you position yourself for long-term success.

Ready to explore the btcc markets for yourself?